Here's How To Claim The 26% Solar Tax Credit

Disclaimer: While we are one of Rio Grande Valley’s top solar installation companies, we are not tax experts. Our suggestions on this page about filing for your solar tax credit are exactly that – suggestions. Because individual situations may vary, please consult a tax professional before filing for your solar tax credit.

Tax time is here, and depending on your paycheck it could be a rewarding time, or a time of frustration. For Texas home and business owners who installed solar panels last year, a special 26% solar tax credit is available on your federal income tax return.

How to claim the tax credit for solar installations

The US federal government offers a tax credit to both home and business owners who install solar power systems. The Residential Renewable Energy Tax Credit is a federal tax credit worth 26% of the total system cost including installation.

As a credit, you take the amount directly off your tax payment, rather than as a deduction from your taxable income. A tax credit is more valuable than a tax deduction because a tax credit reduces the tax you pay dollar-for-dollar whereas a tax deduction simply lowers your taxable income.

You can claim the 26% solar tax credit for your primary & secondary residences, and for either an existing structure or new construction (new home). To claim the federal solar tax credit, you must file IRS Form 5695 as part of your tax return; you calculate the value of the solar tax credit on the form, and then enter the result on Form 1040.

If you end up with a bigger credit than you have income tax due, the excess amount may be carried forward to the succeeding taxable year (2022).

Note: The credit applies to the year in which you go solar. So only if you installed solar panels before December 31, 2021 can you apply for the 26% solar tax credit when you file your 2021 income taxes this April.

If you haven’t gone solar yet, you can still take advantage of a tax credit for the amount of 26%. Contact Us and schedule your solar savings analysis today!

Solar Tax Credit FAQs

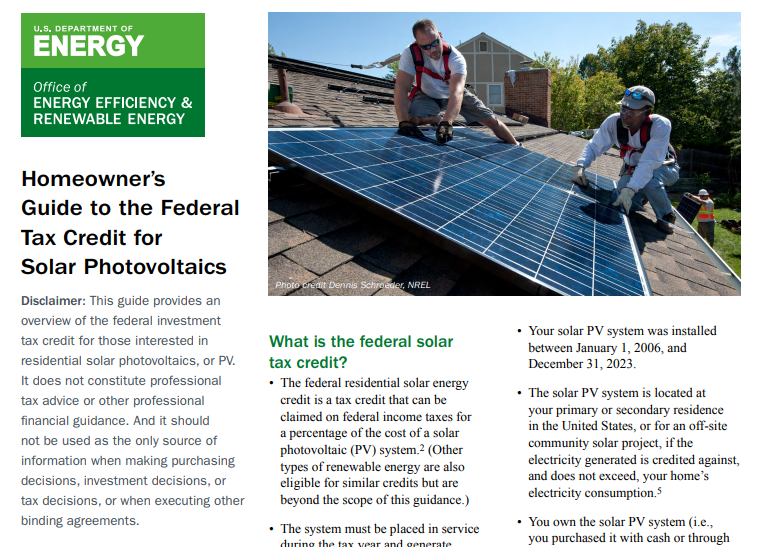

All information below has been taken from the Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics from energy.gov

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe. For example, claiming a $1,000 federal tax credit reduces your federal income taxes due by $1,000.

Am I eligible to claim the federal solar tax credit?

You might be eligible for this tax credit if you meet all of the following criteria:

• Your solar PV system was installed between January 1, 2006, and December 31, 2023.

• The solar PV system is located at your primary or secondary residence in the United States, or for an off-site community solar project, if the electricity generated is credited against, and does not exceed, your home’s electricity consumption.

• You own the solar PV system (i.e., you purchased it with cash or through financing but you are neither leasing nor are in an arrangement to purchase electricity generated by a system you do not own).

• The solar PV system is new or being used for the first time. The credit can only be claimed on the “original installation” of the solar equipment.

• The system must be placed in service during the tax year and generate electricity for a home located in the United States. There is no bright-line test from the IRS on what constitutes “placed in service,” but the IRS has equated it with completed installation.

• In December 2020, Congress passed an extension of the ITC, which provides a 26% tax credit for systems installed in 2020-2022, and 22% for systems installed in 2023. The tax credit expires starting in 2024 unless Congress renews it.

Related Reading: What’s The Best Solar Panel Warranty?

Save Money With Solar Panels In Texas!

StarAlt Solar is proud to be the leading solar installation company in The Valley, with new offices opening in other locations very soon! Contact StarAlt Solar of McAllen or Request A Free Solar Consultation to learn more today!

Disclaimer: While we are one of Rio Grande Valley’s top solar installation companies, we are not tax experts. Our suggestions on this page about filing for your solar tax credit are exactly that – suggestions. Because individual situations may vary, please consult a tax professional before filing for your solar tax credit.